What's Your Net Poultry Position?

Value investors think differently to the crowd. They're not contrarian, just 'decided'. They know 'why'. And this makes them different.

Which would you rather be as an entrepreneur? A trader, or an investor.

Traders win by margin. Investors win by harvest. Which do you choose?

Not having a net position makes you a market trader.

Whereas, having a net position makes you an investor.

And I would always want to have a net position. Here’s 152 billion reasons why…

All markets are held on tension by a single dynamic: Buying vs. selling. The trade.

A trade happens when somebody buys from somebody selling.

Financial markets are no different from the poultry market.

In the same way people might buy and sell shares in a broiler farming business, people buy and sell the actual broiler chicken.

But on a more definitive level, to understand what drives markets, we can separate participants into the following 2 camps…

Traders (speculators)

Investors (owners)

Arguably, both can make a lot of money.

So, in that way, you might say that they are sort of similar.

But under inspection - ‘how’ they do it, couldn’t be further apart.

A trader works by picking up a position.

Any position that wins the day.

Emphasis on the word ‘day’.

Hence the phrase: ‘day trader’ (which applies to a trader who looks to hold the stock they buy for no longer than the day in which they bought it i.e. buying and selling before the sun goes down).

Their aim is to make a profit from the difference between sell price and buy price on each trade.

The larger that difference, the more money a trader makes.

So, as you can image, conditions that favour potential trading profit inc. volatility and predictability = prices moving, plus knowing where prices are likely to move.

But a trader doesn’t know. He reads and waits, anticipates what might happen next. Picks his position. Then trades.

Let’s think about this as a physical poultry market.

Broilers are selling for $5. And prices are going up $2.5 per day - because stock is running low.

A trader has $50 in cash. Buys 10 broilers today. Sells them for $75 tomorrow. He makes $25 profit in a few hours - with little effort.

Broiler stock floods the market and prices begin plummeting, by $0.50 per day.

Prices settle at $2. A trader buys 10 broilers today at $20 and freezes them - to hold. But by the following week, prices return to a norm of $5. He then sells them for $50 and makes $30 profit.

A trader’s fortunes come from the difference made by switching positions at optimal moments, for profit.

Mistime it - and losses are made.

However, time it right - and gains are made.

Speculation. No net position.

Investors, on the other hand, are an entirely different breed.

Investors own.

And if you’re in the poultry production game i.e. broilers or layers, for example…regardless of how big or small your business (1 bird or 100K birds)…

…then by definition, you’re an investor (not a trader).

As an investor, you win - not by switching positions - but by holding your position.

Say, you’re a broiler farmer -

You’ve bought equipment, prepared land and stockpiled feed. You’ve therefore chosen to farm broilers.

To suddenly switch position and pivot your broiler farm into a grocery store and sell broilers to the public - it would take considerable infrastructural cost and time to implement.

It couldn’t be done in a month…let alone a week, much less a day.

So, by owning the farm - you’ve decided for the long term what your position in this market is.

In other words, you’ve invested.

Here’s how things would play out…

Broiler prices are $5 and the rearing cost per bird is $2.5 - your profit is $2.5 per bird.

Rearing cost per bird increases to $5 and prices drop to $4 - you’re losing $1 per bird.

Regardless, you can’t switch - you’re invested.

OK, so right now…being a trader seems far more attractive, right?

Simply, because you can, sort of, choose your commercial destiny, day by day.

Get a weather report and do accordingly.

Sunny outside? Sell t-shirts.

Heavy rain? Sell umbrellas.

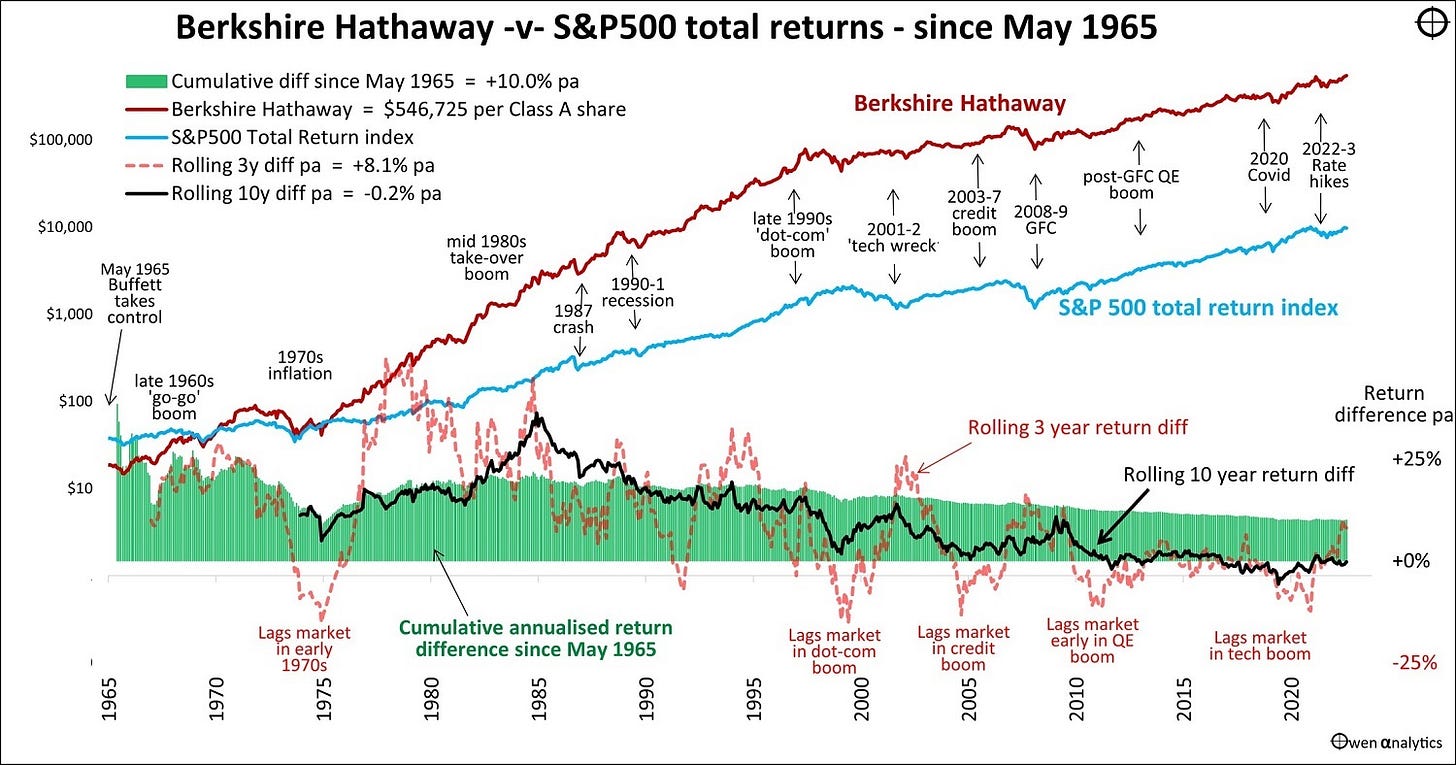

However, if you’re thinking this way…here’s a single graph that will change your mind:

1st impressions? (Sure, there’s a lot going on)…so let me simplify…

The 2 things you need to pay attention to in the graph above are:

The red line = Berkshire Hathaway (Warren Buffet’s investment company) share price from 1965 to 2025 (60 years of investing).

The blue line = S&P 500 index (500 leading companies listed on stock exchanges in the United States) share price from 1965 to 2025 (60 years of trading)

The takeaway?

When Warren Buffet took over Berkshire Hathaway in 1965 it was valued at -50% compared with the S&P 500 (…’S&P 500’ = the combined share price of the top 500 companies traded in the US stock exchanges).

After 60 years of his investments, Warren Buffet’s Berkshire Hathaway is now valued at +1,500% compared with the S&P 500.

Wow.

But here’s the kicker…

Now, read the annotations (in black text) along the timeline…let me summarise:

May 1965 Buffet takes control (of Berkshire Hathaway)

Late 1960’s go-go boom

1970s inflation

Mid 1980s takeover boom

1987 crash

1991-1 recession

Late 1990s dot com boom

2001-2 tech wreck

2003-7 credit boom

2008-9 GFC (‘Global Financial Crisis’)

2011-12 GFC QE (‘Quantitive Easing’) boom

2020 Covid

2022-23 rate hikes

…in other words…

…a LOT of trading headache, uncertainty, rollercoaster madness, yes - Wall Street worries and woes.

Up…down…up…down…up..down…

Nauseating at best. And if you were able to keep your lunch down - you might just walk away from the ride in one piece.

However, ‘keeping your lunch down’ is just the point.

Through 60 years of financial yo-yo’ing…

…1 thing remained consistent (and no, I’m not necessarily talking about Warren Buffet, because even investors lose at times)…

But the unchangeable was this:

People lived.

People ate. People drank. (You simply can’t live without it.)

You can’t have a world without food.

As quoted from the video above, here’s Warren’s investment take on that universal truth:

“We’re [Berkshire Hathaway -Warren Buffet’s investment company] a net buyer of stocks. Just like being a net buyer of food, I expect to be a net buyer of food for the rest of my life and I hope that food goes down in price tomorrow.”

Said differently,

Bet on the inevitable.

But wait - there’s nuance to Warren’s insight:

“When stocks are down, we’re going to be buying on balance. We’d rather buy at a lower price than a higher price…most are savers which means they’ll be net buyers, so they should want the stock market to go down, they should want to buy at a lower price. But they’ve got that feeling that they just feel better when stocks are going up.”

As an investor, your net position is set.

Either…

Buying.

Or, selling.

Again, if you are producing broilers or eggs, then you are a seller of those products. Naturally.

However, as I said, there is nuance to what Warren said.

We’re missing a 3-letter word that makes the WORLD of difference…

“NET”.

Defined as:

“…the amount that remains after deductions are made.”

In the context of trade:

A net buyer is an investor who both buys and sells a particular stock/item - but after all trades are done, they have always bought more than sold.

Hence, a ‘net buyer’.

(The contrary is true for a ‘net seller’.)

So, when Warren says that he is a net buyer of stocks, he means he both buys and sells stocks…

(…now, you might be thinking → “…but doesn’t that then make him a trader, not an investor??”)

…however, the nuance is this:

Whilst both buying and selling stocks - Warren’s position is always a ‘net buyer’ i.e. after all trades are done, Warren’s company is actually left with bought stock, not sold stock.

This makes him an investor.

Come what may, he’ll always be an owner (investor) of stocks.

Therefore, by virtue of this, we would say that an investor has belief.

A trader has no belief. He doesn’t care to hold. Only to profit.

But now, just reflect on that +1,500% 60 year victory by Warren’s investment strategy (having started from a -50% trailing deficit) against the traders of Wall Street - and then, let’s recount Warren’s earlier quote, once more:

“I expect to be a net buyer of food for the rest of my life and I hope that food goes down in price tomorrow.”

Warren believes in everyone needing to eat food. Warren therefore bets on food.

He can’t see a world without it. And so Warren will invest in businesses that produce or sell food for the long term - even if they drop in market value…

…in fact, ESPECIALLY if they drop in market value.

Why?

Again - we come back to it.

Warren believes in everyone needing to eat food.

Investors bet on the inevitable.

Cheap food today will become expensive food tomorrow when the conditions change.

But what doesn’t change, is the need for food.

And in the meanwhile, if you run a food business well so…:

You always have an audience, regardless of conditions.

You always run profitably.

Then, there is NO REASON to sell your ownership of that business. You hold it. You own it.

And the market has no choice, but to buy your food.

This is where real financial wealth lies.

It’s called value investing. More on this to come…

Now over to you…

What’s your net poultry position?

Have you ever considered yourself a poultry investor?

Are you tired of worrying about market conditions affecting the poultry trade?

I’d be interested to hear from you.

(I read every comment)

Speak soon,

Temi

P.S. If you want to build a bankable poultry investment plan — there’s a better way.

I have a 1-to-1 coaching service which is exactly that.

It’s like having me partner with you on your project - with all my pro-tools.

👉 Click here for Advanced Poultry Pickup coaching.

Simply sign up and book yourself into my LIVE office hours.