The True Value of Entrepreneurism

Your poultry venture might just be the ideal bailout package that an investor is looking for, but is there a better way?...

Berkshire Hathaway.

Run by 2 of the most prolific financial investors in our modern era:

Charlie Munger and Warren Buffet.

The pair are authentic investors…

…according to the very definition:

from Latin investire "to clothe in, cover, surround," from in "in, into" (from PIE root *en "in") + vestire "to dress, clothe," - Etymonline.com

A different breed.

Whereas most financiers seek profit by placing prudent bets on businesses…

…these two don’t seek to ‘make money off’ their investments…

But rather, by ‘putting them on’.

"to dress, clothe,"

An entirely different mindset, to say, private equity - which famously uses leverage to inject artificial growth and sell for profit.

Warren and Charlie see shareholders as partners.

People who like their philosophy and are willing to go along for the ride.

The secret to their success?

They value people who value the people they serve and lead.

That’s the winning formula.

Where they wholly own, they never sell.

Where they partially own, they rarely sell.

Their holding company is a mega-cash generator.

And for most financially uninitiated, this might sound like the end of the line.

But for those in the know (most of all, Warren and Charlie themselves) mega-cash is actually their biggest problem.

Most folks perceive not having money a problem.

But as for Charlie and Warren - money, they have.

However, money is continuously depreciating.

Their wealth is decaying.

Because the value of money constantly degrades.

It’s perishable…like apples and pears.

Even as you read this article:

That $10 (…£10, or whatever currency you hold in your wallet or purse) is worth less now than it did just minutes ago.

And why?

Inflation.

The silent financial canker that causes monetary prices to continually increase…

…or rather, the purchasing power of our money to decrease.

And all because we live in a credit economy.

We buy by borrowing.

And at the cost of interest (usury).

Therefore every cost and every purchase must be caveated with the additional cost of interest - which naturally inflates.

And worst still, interest compounds.

It snowballs.

Therefore the cost of goods and services continually and rapidly rise.

Here’s what I mean:

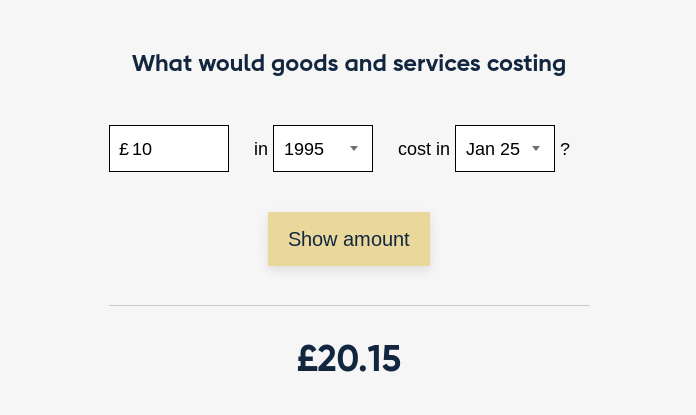

This example is taken from The Bank of England Inflation Calculator.

It shows that over the last 30 years between 1995 - 2025, the cost of goods and services have doubled:

From £10.00 to £20.15.

Another way of saying this is:

The spending power of money has…

Halved.

This is the rate at which Warren and Charlie’s money is perishing.

Frightening pace when you think about it.

And speaking for fright - it’s this reality (fear) that keeps every investor up at night.

The fact that idle money, becomes no money at all - very quickly.

And so their vocation and profession becomes putting their money to profitable use.

Lending.

Contrary to our lay, consumer-based mindset -

Investors are not ‘doing borrowers a favour’ by lending.

Perish the thought.

Investors are the beneficiaries.

In fact, without entrepreneurial ventures (which promise returns above the meagre interest rate of return)…

…investors would have their multi-million dollar palaces built on sinking sand.

By offering investors viable opportunities for growth, entrepreneurs are actually bailing out their cash-rich neighbours from inevitable bankruptcy.

Understand that your venture is a potential lifeline to a professional venture-backer.

Mineral, nutrient-rich soil in which to plant their seed (which if left in their pocket, soon becomes dust).

And by comparison, it could be argued investors are the more needy of the two.

It comes down to a game of alternatives.

You see investors don’t just need just ANY growth.

They need growth that exceeds a rate of discount.

In other words, growth that compared with the interest rate, returns a superior profit.

Or, said differently again, outperforms the interest rate.

This makes a venture viable.

But still, an investor might pivot to ‘playing’ the markets for bigger stakes.

But then they leave their riches at the mercy of chance.

Think, Roulette, slot machines or Bet365…

So, instead, many more prudent investors, much like our two - Charlie Munger and Warren Buffet invest their funds in long-term buy-and-hold stock strategies.

They buy portions of companies they believe are stable winners.

And they simply keep ‘em.

These are companies that have a history of performing solidly, year on year, generating attractive rates of return.

So compared with the uncertainty of gambling, or the insufficiency of interest rates…

…a good venture is the clear winner, every time for a wise investor.

Hence an investor’s appetite for research.

Always knowing what new prospects or opportunities are available within their realm of expertise.

And that’s where you come in…isn’t it?

…or is it?

Must you seek investment to start up?

Is there a more profitable alternative?

In short -

Yes, there is!

You see, lending, whilst presenting a shortcut to capital - naturally carries the expense of interest.

And as we know now, this interest compounds to accumulate rapidly, generating considerable cost.

And so, interest is known as the cost of ‘inorganic’ growth.

The alternative to this inorganic approach?

To bootstrap.

(Or, self-fund a business.)

“But what if I don’t have funds?!”

Then, better still is a healthy measure of wit can go a long way.

Been worth more gold on many occasion.

The smarts to build asset value on a strap or a string sure takes some effort, but the rewards can be astonishing.

100% profit on every dollar earned.

All yours.

Is bootstrapping a myth? Are such companies real?

Ever heard of Facebook?

How about Dell?

That’s right….ALL BOOTSTRAPPED.

$0 of outside funds to get started.

And just for reference value:

“As of Q3 2024, Berkshire Hathaway (remember Charlie and Warren, our two investors from earlier?) holds 400 million Coca-Cola shares, valued at more than $28.74 billion, making up approximately 10.79% of the fund's portfolio.”

(Source)

Not bad for a bootstrapped drinks company started…

“[in 1886, by a local pharmacist in Atlanta, GA who] carried a jug of the new product down the street to Jacobs' Pharmacy, where it was sampled, pronounced "excellent" and placed on sale for five cents a glass as a soda fountain drink!”

(Source)

Now, if Coca-Cola started from a single jug carried by a solopreneur to a local pharmacy…

…and today, carries 10% of the wealth of one of the world’s richest men - some $28.74 billion…

..just think what a single batch of broilers or layer eggs taken to your local:

market

restaurant

grocery store

…might eventually turn into through hard graft and of course a healthy dose of wit, in years to come?

Now, hold that thought.

We’ll speak soon.

Temi

Whenever you're ready, there are 4 ways I can help you:

1. Advanced Poultry Pickup (1-to-1 Project Consultancy): Unlimited, lifetime consultancy at a single one-off price. All sessions conducted over Whatsapp video. Ongoing project assistance, when you need it. Custom apps, documents or templates to take away and recorded tutorials. Get access.

2. Master Poultry Passes (Email Educational Courses + Digital Tools): Join yours truly plus a select panel of top-performing business consultants and poultry voices inside of the Master Poultry Passes eCourse. This comprehensive collection of courses will teach you the techniques used by the pros to dominate their area of expertise. Get access.

3. TBBP Org. Online Community for Poultry 'Preneurs: Join 9,000+ students in my multi-disciplinary poultry entrepreneurship learning hub. Discover how to plan, develop, scale and exit a profitable high-performance poultry business. Get access.

4. Instant Chicken Snippet Newsletters: To date my poultry entrepreneurship emails have reached over 15,000 subscribers across all channels which amounts to over 500,000+ mailshots sent worldwide. Through this series, I bring the most revealing poultry hacks from the world’s leading experts to light. Get access.